Cryptocurrency Price Action Strategies to Negotiate Bitcoin (BTC)

As a merchant, it is essential to stay informed and adapt their strategies to the dynamic environment of the cryptocurrency market. An Effective Approach is to use Price Action Strategies to Identify Possible Trading Opportunities in Bitcoin (BTC). In this article, we will dieepen some popular price action strategies to negotiate the btc and provide a comprehensive guide on how to implement theme.

What are price action strategies?

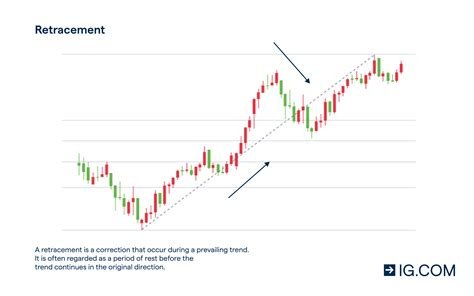

Price Action refers to the Study of Market Movements and Standards in the Market. IT Involves The Analysis of Price Action Charts to Identify Trends, Support Levels and Resistance and Other Important Features That Can Inform Negotiation Decisions. Price Action Strategies are specifically Focused on Using This Information to Make Informed Investment Choices.

Popular Price Action Strategies to Negotiate Bitcoin (BTC)

- Trension Below

: This Strategy Involves Identifying and Following the Price Action Direction. Buy When the Price is to go up and sell when to down.

- Linda de Range : This approach Involves Identifying Support and Resistance Levels Within A Specific Price Range and Dealing with Agreement. Buy in Support, Resistance Sale and Be Prepared to Adjust Your Position As The Market Moves.

- ICHIMOKU CLOUD : ICHIMOKU’s Cloud is an advanced technical analysis tool that provides a comprehensive view of a chart. It Includes Several Lines, Such as Tenkan-Sen and Kijun-Sen, which can help you identify trends, support levels and resistance and other important features.

- Bollinger bands : This strategy Involves Using Bollinger Bands to Identify Possible Negotiation Opportunities. The Bands Consist of a Moving Average and Two Standard Deviations Plotted in the Chart, Providing a Break Within which Prices Tend to Move. Buy When the Price is Below the Lower Band and Sell When It is Above the Top Band.

- Wave theory : This approach Involves Identifying Waves Within A Chart and Using Them to Predict Future Price Movements. Wave theory is based on the idea that markets usually repeat patterns, making it a useful tool for traders.

How to implement Price Action Strategies At Bitcoin Trading

- Use Technical Indicators

: Use Popular Technical Indicators Such As RSI, MacD, and Stochany Oscillator to Analyze Price Action and Identify Possible Negotiation Opportunities.

- Study Chart Patterns : Family with Common Graphics Patterns Such As Hammer, Inverted Hammer and Shot Star, which can help you identify trends and stands of support and resistance.

- Identify Support and Resistance Levels : Use Ichimoku Cloud, Bollinger Bands or Other Tools to Identify Support and Resistance Levels Within A Specific Price Range.

- Create a negotiation plan : Develop a negotiation plan that describes your strategy, risk management parameters and input and output rules based on the strategies you have chosen.

- Practice and Refine : Regularly Practice Your Strategies Using Historical Data Or Support Them Against Simulations to Refine Your Approach.

Conclusion

Price Action strategies are an effective way to identify Possible Bitcoin Negotiation Opportunities (BTC). When Studying Price Action Charts, Identifying Support and Resistance Trends and Levels, and Using Technical Indicators and Graphic Standards, You Can Develop A Comprehensive Strategy to Negotiate BTC. Remember to Practice and Refine Your Approach Regularly to Ensure That It Remains Effective in the Long Run.

Additional resources

* Books : Michael Casey’s “Reminiscences of A Coiner”, John J.