Candela graphic models: a trader guide to unlock the insights on the cryptocurrency market

The world of cryptocurrency trade has become increasingly complex, with traders based on various tools and techniques to make informed decisions. An essential aspect of trading in cryptocurrencies is the understanding of the models of candle graphics, a powerful tool to identify potential trends and market opportunities. In this article, we will deepen the basics of the cards of candelabra and explore how they can be used by traders to obtain a competitive advantage.

What are the rankings of the candelabra?

A candlestrate graph is a graphic representation of the price movements over time, traced on an X axis that represents the day of trading and a Y axis that represents the price level. The graph has two main components: the open, closed, upper and low prices, which represent the opening and closing prices of each bar.

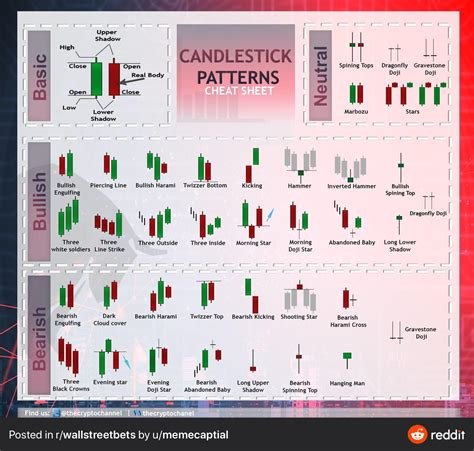

Basic candlestick graphic models

The graphs of the candelabra are made up of various patterns that can be used to identify trends and reversals on the market. Here are some of the most common candle graphic models:

- Suspended man : a reason that swallow bearish, characterized by a large green body with a small red wick, which indicates a potential reversal.

- Shooting Star

: a model to swallow up, with a long green body and a short red or black bar, which signals the end of a reduction trend.

- Mack’s Hammer : a reliable hammer candle model, consisting of a small body with an inverted head and a long tail, which indicates a potential reversal.

3

How to identify the graphic models in Candela

To effectively use candle graphic models in your trading strategy, you must be able to recognize and interpret these patterns. Here are some suggestions:

1

- Concentrate on key levels : identify the support and resistance levels that can help you set price objectives and confirm potential inversions.

- Combine with other indicators : use candelabrine graphs together with other technical analysis tools, such as mobile or RSI averages, to create a more complete trading plan.

Candolar graphic models in cryptocurrency trading

In the cryptocurrency market, candle graphic models can be particularly useful for identifying potential tendencies and inversions. Here are some ways in which operators use the graphic designers to obtain insights on the cryptocurrency markets:

- Incidentally of the tendent : the candle graphics can help traders identify when a trend is reversed, allowing them to take profits or set up the arrest levels.

- Tracking of price movements : by analyzing the models of candelabra, the traders can keep track of prices and anticipate potential reversals or unlocking.

- Setting the support and resistance levels : trader uses candelabra graphics to identify the key and resistance key levels that can help them fix price objectives.

Advanced candle graphic models for cryptocurrency trading

While the basic candle graphics models are essential for beginners, the most advanced traders often look beyond the foundations to create a complete trading strategy. Here are some models of advanced candle graphics used by cryptocurrency traders:

- Cloud Ichimoku : a Japanese candlestick graphic model that provides valuable information on the trends and price movements.

- Stop models : Candolar graphs with specific stop models can be used to identify potential reversals or releases.

- Trendy line models : Traders use various trendy line models, such as the Fibonacci retracing tool, to identify the key and resistance key levels.