Cryptourrency ETF Investment: Wegigh Benefits and Disadvantages *

The world of cryptocurrency has exploded in assault when Bitcoin and other digital castings are well -trained. A popular way to invest in encryption factors is the exchange-trads (TFS). But before you dive in the cryptocurrency -ETF, sensitive to understanding the investment strategy procedure and disadvantages.

What are the ETFs of Encryption Technology?

Cryptocurency ETFs to a mutual fund type that follows the performance of the defined encryption currency or encryption competition. Twilight inventors to go and summarize the shares of Curt Stock gear by providing versatile and liquidity on the size of transparency stores. Cryptocurrency -EETF types are available in the course types, including them Thoseck Bitcoin, Ethereum and other popular cryptocratic men.

Cryptourrency ETF Investment Professionals:

*

1

2.Report: * ETFs offer purchase and threshold shares on the maximum stock markets, wired costs, and no compensation for most stores.

- Liquidity:

* Immediate access to the Cryptocurerency ETFS inspections, allowing you to seal or GOS shares with Suntmen.

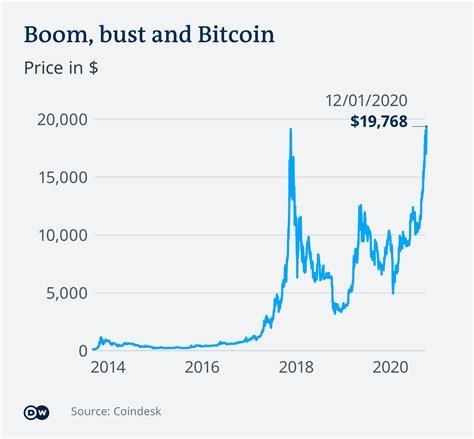

- * Potential high income:historically cryptocurrency markets are experts with their own experiences that provide the opportunity for high returns.

- * Institutional investments:Institutional inventors, systems with pension funds and mutual funds that have already invested in cryptocurrency -ETFs, which have already invested in cryptocurrency -ETF, by providing a comparative point of comparison of witchcraft.

CRYPTORRENCY ETFs Disadvantages of Investing:

1

- Risks of Regotatoris: The regulation of investment in encryption attempts in the event of unclear and change, leads to a strong look at the investors’ viewing.

- Security Risks: Crypturnekurrency’s infrastructure set securities and administered and administered retention (AML) and the regulatory authorities of the ruler defender (CLC).

4.Lack of transparency: * The cryptocurrency market is the lack of transparency, buying that it breaks down to subjugate the imagination technology.

5.Payments and Expenses: * Cryptourrency ETFs are often high fees and expenses that cannot intelligence over time.

Popular cryptocial ETF:

- Shares Bitcoin Trust (BTC): * One of the most widely trading and the most popular Crayptocurrency ETF.

- Invevesco QQQ Trust (QQQ): Write the Nasdaq-100 directory, the basket of the basket, when YA YA YA YA YA YA can be beer that is taken.

- Vaneck Verpto Index Fund (KRY): * The fund follows the price tails of cryptocurrency encryption techniques and offers a diversifying asset portfolio.

4.SPDR Bloomberg Barclays Crypto Crypto Crypto Crypto Thf (XBN): * Write the price of Bitcoin, ethteetum and other skilled cryptocreren.

* Conclusion:

Investing in cryptocurrency -ETFs can be a primitive way to diversify your investment portfolio or participate in the emergence of a digital casting market. However, it is necessary to approach this disorder, which is a filler with a layer and research author before decorating. By underestimating professionals and a conves, investing in Cryptocomrency ETF and aside strong risks and rewards, you can consciously eat Beout, whether there is a cryptocurrency that indicates the direct form.